new mexico pension taxes

Is my retirement income taxable to New Mexico. Disabled Veteran Tax Exemption Any veteran who rated 100 service.

High earners individuals who have income above 210000 and couples that file jointly with income above.

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

. Should you consider a lump sum pension withdrawal for your 500K portfolio. E-File Directly to the IRS State. A one-time refundable income tax rebate of 500 for.

Michelle Lujan Grisham a Democrat signed. Retirement income from a pension or retirement account such as an IRA or a 401 k is taxable in New Mexico. If you plan to supplement your retirement income with investment income remember that you pay tax on all capital gains.

Should you consider a lump sum pension withdrawal for your 500K portfolio. Ad E-File Federal to the IRS for Free and Directly to New Mexico for only 1499. Does New Mexico offer a tax break to retirees.

New Mexico is one of only 12 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into Social Security and. By Antonia Leonard May 31 2022. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each.

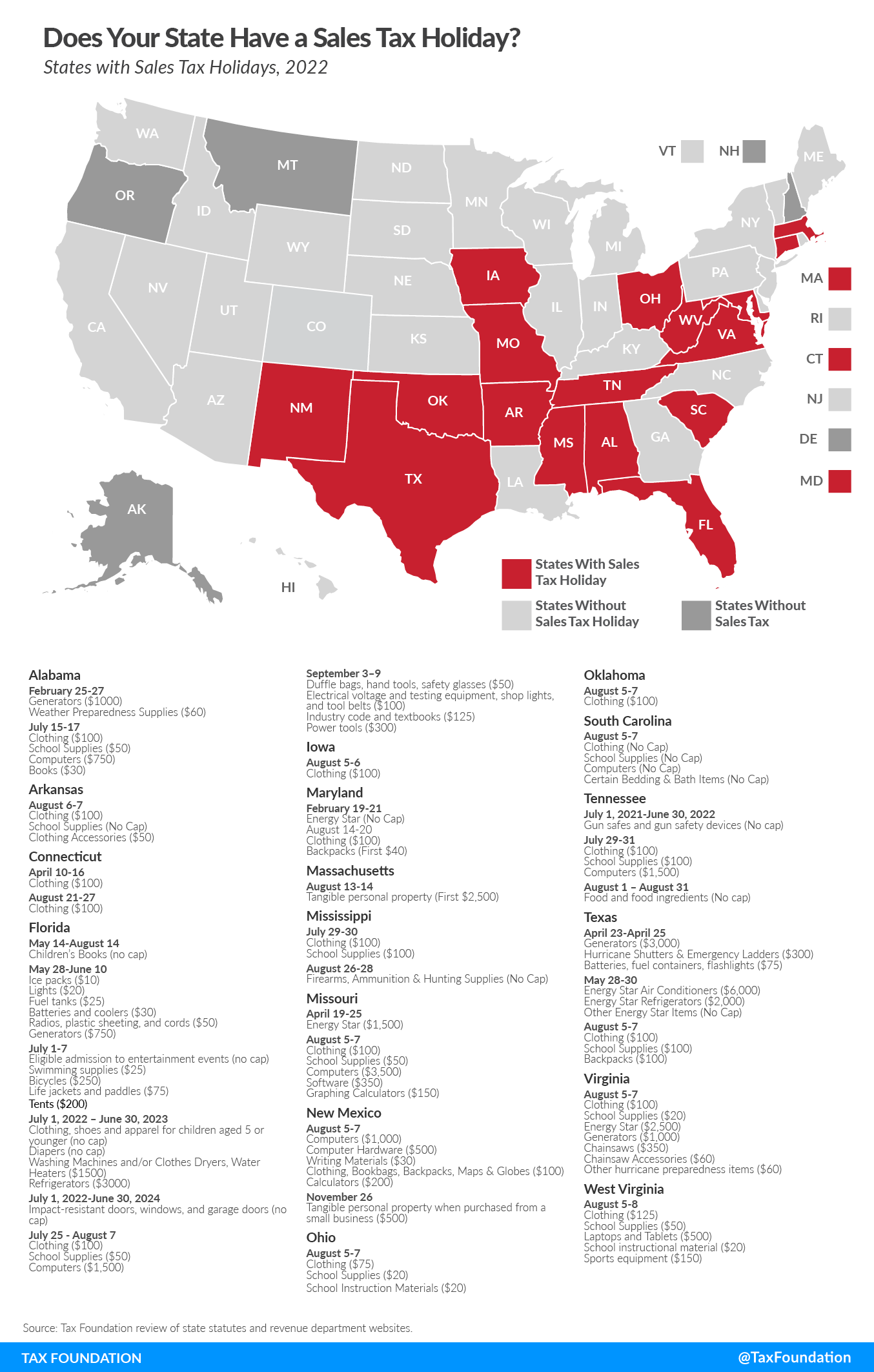

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. 52 rows The following taxability information was obtained from each states web site. New Mexico public pensions are the state mechanism by which state and many local government employees in New Mexico receive retirement benefits.

Out-of-state and other pensions are fully taxed along with income from a 401 k or IRA. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Free 2021 Federal Tax Return.

There are fees. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to. Removes the 90 percent salary cap on pensionable compensation The changed COLA is expected to vary between 05 and 3 each year and average out to 164 annually.

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. We also strongly recommend that you do some further preparation such as discussing. A new state law eliminated the state income tax on Social Security benefits for most retirees starting with the 2022 tax year.

However for 2021 taxes a new bracket is being introduced. A new refundable child tax credit of up to 175 per child which will save New Mexico families 74 million annually. NEW MEXICO CUTS THEIR TAXES ON RETIREE BENEFITS.

New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits. Does New Mexico offer a tax break to retirees. Property Taxes The effective property tax rate across Kansas is 141.

New Mexico State Senator Bill Burt R-Alamogordo reintroduced legislation Tuesday to provide a new phased-in personal income tax deduction for military retirement income of uniformed. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted. According to the United States Census.

New Mexico is one of only 12 remaining states to. In 2022 the New Mexico Legislature passed a bill and the Governor signed that eliminates taxes on Social Security benefits for. New Mexico offers a deduction of 40.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Easily Download Print Forms From. As they work teachers and their employers must contribute into the plan.

Blank Forms PDF Forms Printable Forms Fillable Forms. Those contribution rates are set by the state. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

How Much Does New Mexicos Teacher Pension Plan Cost. New Mexico Veteran Financial Benefits Income Tax Active duty military pay is tax-free. New Mexico this month stopped collecting income taxes on social security benefits for individuals who make 100000 or less or joint tax filers who report 150000 or less in.

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At A Gross Domestic Product Developing Country Social Data

New Mexico Retirement Tax Friendliness Smartasset

The Most Tax Friendly States To Retire Cheyenne Wyoming Wyoming Best Cities

Social Security Disability Income H R Block

State Pension Changes 2019 What Is It And What S Different Than Last Year Pensions How To Plan Retirement Planning

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

States That Don T Tax Retirement Income Personal Capital

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Where S My State Refund Track Your Refund In Every State

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

New Mexico Retirement Tax Friendliness Smartasset

Usa Clothing Company Earning Statement Template In Word And Pdf Format Datempl Templates With Design Service In 2022 Statement Template Templates Words

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

At What Age Is Social Security No Longer Taxed In The Us As Usa

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)